maryland ev tax credit 2021 update

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Requiring the Motor Vehicle Administration and the Maryland Department of the.

How Do Electric Car Tax Credits Work Kelley Blue Book

893 of the funds budgeted for the FY22 EVSE program period have been committed with 19258900 still available.

. Increasing from 1200000 to 1800000 the amount of rebates that the Maryland Energy Administration may issue. From April 2019 qualifying vehicles are only worth 3750 in tax credits. Nissan is expected to be the third manufacturer to hit the limit but.

Updated April 2022. The irs tax credit for 2021 taxes ranges from 2500 to 7500 per new electric vehicle ev purchased for use in the us. For more general program information contact MEA by email at michaeljones1marylandgov or by phone at 410-598-2090 to speak with Mike Jones MEA Transportation Program Manager.

The credit ranges from 2500 to 7500. Increasing from 1200000 to 1800000 the amount of rebates that the Maryland Energy Administration may issue. It also proposed to increase the annual funding from 6000000 to 12000000.

Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit on a qualifying plug-in electric or fuel cell electric vehicle regardless of whether they own or lease the vehicle. Eligibility for rebate. Beginning on January 1 2021.

Funding Status Update as of 04062022. In January the Clean Cars Act of 2020 was introduced to extend the program for another three years. Pluginsites is tracking the progress of 2021 ev legislation in maryland virginia new york.

Small neighborhood electric vehicles do not qualify for this credit but. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles.

Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase. The credit amount will vary based on the capacity of the battery used to power the vehicle. For model year 2021 the credit for some vehicles are as follows.

You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Maryland EV Tax Credit Status as of June 2020 The Clean Cars Act of 2020 proposes to increase the funding for the Maryland electric vehicle excise tax credit.

Then from October 2019 to March 2020 the credit drops to 1875. Establish the Office of Climate Counsel in the Maryland Public Service Commission and include the Climate. Funding Status Update as of 04062022.

Decreasing from 63000 to 50000 for purposes of the electric. 67 rows EV Tax Credit. The irs tax credit for 2021 taxes ranges from 2500 to 7500 per new electric vehicle ev purchased for use in the us.

Maryland citizens and businesses that purchase or lease these vehicles. The credit ranges from 2500 to 7500. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandonedThe EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors.

Maryland Excise Tax Credit Not Reauthorized for FY 2021. Requiring the Motor Vehicle Administration and the Maryland Department of the. State andor local incentives may also apply.

Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. After that the credit phases out completely.

Mar 28 2019 at 355 pm. Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles. Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy Administration.

If the credit is more than the state tax liability the unused credit may not be carried forward to any other tax year. Several months later it seems that revisions to the credit are returning to lawmaker agendas. Annual funding would increase from 6000000 to 12000000 through fiscal year 2023 under the proposal by Governor Larry Hogan.

Unfortunately the bill didnt pass before the Maryland General Assembly adjourned early due to COVID-19. Excise tax credit for electric vehicle purchases. Beginning September 1 2021 a qualified resident of the Commonwealth who is.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the amount of the State income tax liability. Amended to strike EV tax credit and only apply to backlog of previous EV purchases on the waitlist MD. Altering for certain fiscal years the vehicle excise tax credit for the purchase of certain electric vehicles.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Beginning September 1 2021 a resident of the Commonwealth who is the purchaser of a new or used electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500 subject to the availability of funds in the Fund. Maryland ev tax credit status as of june 2020.

Build Back Better Expands Ev Tax Credit With 12 5k Incentive On American Made Electric Cars

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Cash For Clunkers 2021 Kelley Blue Book

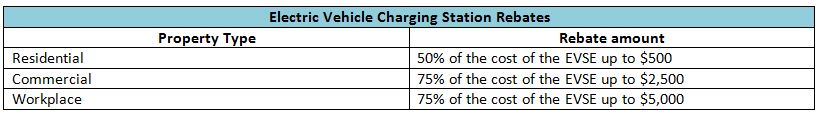

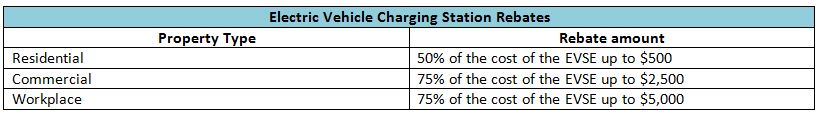

Rebates And Tax Credits For Electric Vehicle Charging Stations

2022 Cost Of Electric Car Charging Station Installation Level 2 3 Homeadvisor

Rebates And Tax Credits For Electric Vehicle Charging Stations

Arcimoto Vehicles Reclassified As Autocycles In The State Of Maryland

How Many Evs Are Registered In Your State You May Be Surprised

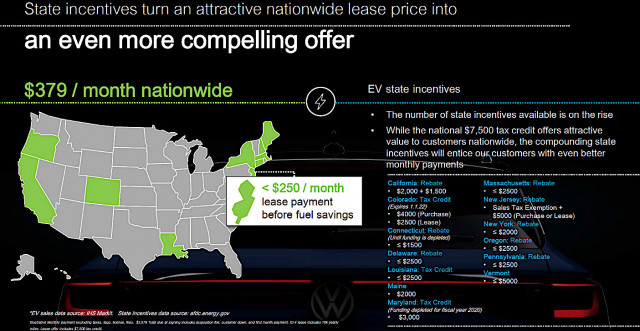

Vw Is Launching Id 4 Electric Suv On Up Front Value And Ownership Costs Not Tech Potential

Maryland Right To Charge Bill Passes Pluginsites

Opinion Biden S Ev Tax Credits Redistribute Wealth Upward The Washington Post

Tesla Model Y Selected For Sykesville Maryland Police Department Cleantechnica

Rebates And Tax Credits For Electric Vehicle Charging Stations

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Electric Vehicles Tax Credit By Car Model Manufacturer 2021

Ev Charging What You Need To Know About Charging Your Electric Vehicle

Rebates And Tax Credits For Electric Vehicle Charging Stations

Maryland S Draft Climate Plan Would Require Buildings To Reach Net Zero Emissions By 2045 Naiop Maryland Chapter

Rebates And Tax Credits For Electric Vehicle Charging Stations